The Centre for Digital Financial Inclusion (CDFI) is an innovation and research centre at the Institute for Financial Management and Research (IFMR), which is an academic institute established in 1970 and headquartered in Chennai. CDFI was established in September 2014 with the objective of using technology in empowering the poor & excluded with tools/information and developing mechanisms to sustain and scale such solutions.

Over the years, CDFI has developed, supported, scaled and sustained award-winning innovative digital solutions for the social sector that have impacted significant no. of citizens across the country. These solutions are driving large scale projects at the national and state level in areas such as Cashless Payments & Financial Inclusion, Benefit Delivery & Social Protection, Health, Farm & Non-Farm Collectives, Data & Outcome-Driven Planning & Governance, and Outreach & Capacity Building.

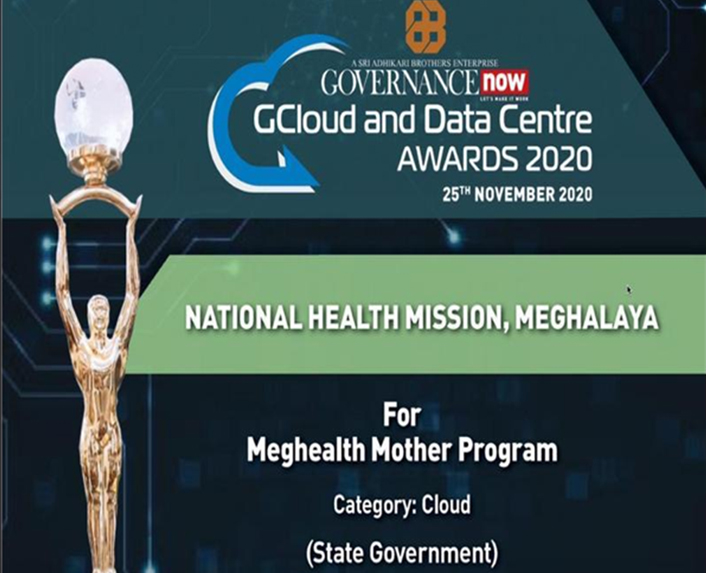

CDFI has partnered with various Central Ministries / Departments such as the Ministry of Rural Development, Ministry of Electronics & Information Technology, Ministry of Woman and Child Development, DBT Mission, and Department of Posts. It is also working with the State Government of Meghalaya and has worked in the past with Chhattisgarh, Telangana, Assam, Maharashtra & Kerala. CDFI is also working with international institutions such as the World Health Organization and Bill & Melinda Gates Foundation.

CDFI has been able to achieve considerable success in the country as an innovator and thought leader in catalysing change through technology. CDFI has been successful in building a trusted network of technology, implementation, and research partners which has enabled it to execute large-scale projects in a cost-effective and timely manner.

Our team comes from diverse backgrounds and brings expertise in developing and scaling innovative solutions in collaboration with public, private and not-for-profit sector

CDFI is providing its Data Driven Governance tools to the Meghalaya Government for its implementation

CDFI was one of the nominees for the Businessline Changemaker awards under the category ‘Changemaker - Financial Transformation’ for the year 2016

Cabinet Ministers, Shri Ashwini Vaishnaw & Shri Rajeev Chandrasekhar presented a memento of appreciation to CDFI for contribution towards Digidhan Mission

The award was won in theGold category to Improve Social Parameters’ in the state’s South West Garo Hills region.

CDFI innovation Sunidhi was the engine behind Rebuild Kerala Platform