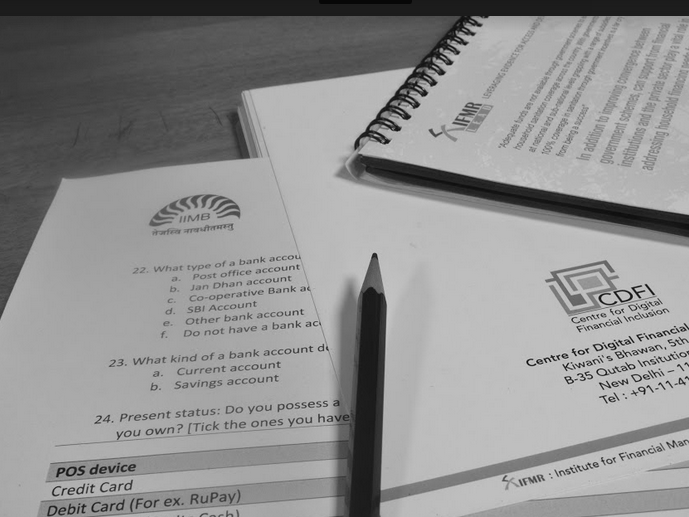

The Digital Innovation Lab is a joint collaboration of CDFI and IIM Bangalore and is set in IIMB campus. The Digital Innovation Lab promotes development and scaling of new digital payment use cases. The Digital Innovation Lab has a ready to use ecosystem comprising of infrastructure, partnerships, collaborators, managerial and technical expertise, solutions, and ability to undertake specialized research.

The objectives of the Digital Innovation Lab are to:

- Further research and innovation in the area of digital payments to the excluded segments

- Identify and demonstrate new digital payment inclusion use cases

- Create public goods and interactive forums to accelerate diffusion of best practices

- To enable research and innovation in digital technology that can be easily adopted by a larger proportion of the target population to access financial services in their daily lives and to improve their livelihoods

Key Activities at the Lab

- Research: The lab undertakes both short term and long term research which could be sector specific (e.g. agriculture, education, health etc.) or project specific (e.g. pre and post intervention assessment studies relating to CDFI projects). Such research focuses on a gamut of issues in areas such as operations, supply chain, technology, socio economic condition, behaviour, etc. amongst others that could further financial inclusion and promote adoption of digital payments.

- Innovation: Innovation is around process re-engineering, simple and contextual technology solutions and applying existing data, information, knowledge and solutions available in the lab to different use case scenarios. For innovation, the lab undertakes activities such as – Ideation, Short Listing, Theming and Building, Evaluation and Approval, Incubation etc.

Key Characteristics of the Lab

- Open Architecture and Collaboration work - This framework enables collaborators such as academia from the Institute and other partner institutes, public and private institutions and organizations, grantors, grantees, individuals and students to come and participate in the Lab

- Learning from others’ experiences - In order to promote learning from others experiences, the Lab brings academia from other geographies to participate in the Lab and share their experiences in the area of financial inclusion and digital payments. Such learning enriches the quality of research and innovation at the Lab.

- Research Fellowship - For domain specific research on financial inclusion and digital payments, the Lab has instituted a “CDFI Research Fellowship” scheme funded by CDFI. This research scheme is available for all interested research students pursuing their doctorates from within IIMB and collaborating institutions like IFMR.

- Summer Internships - The Lab invites students from different technology and management institutes to pursue their summer internships at the Lab. These summer interns assist the research team and benefit from exposure at the Lab.