Analyst

Sep 19 2017

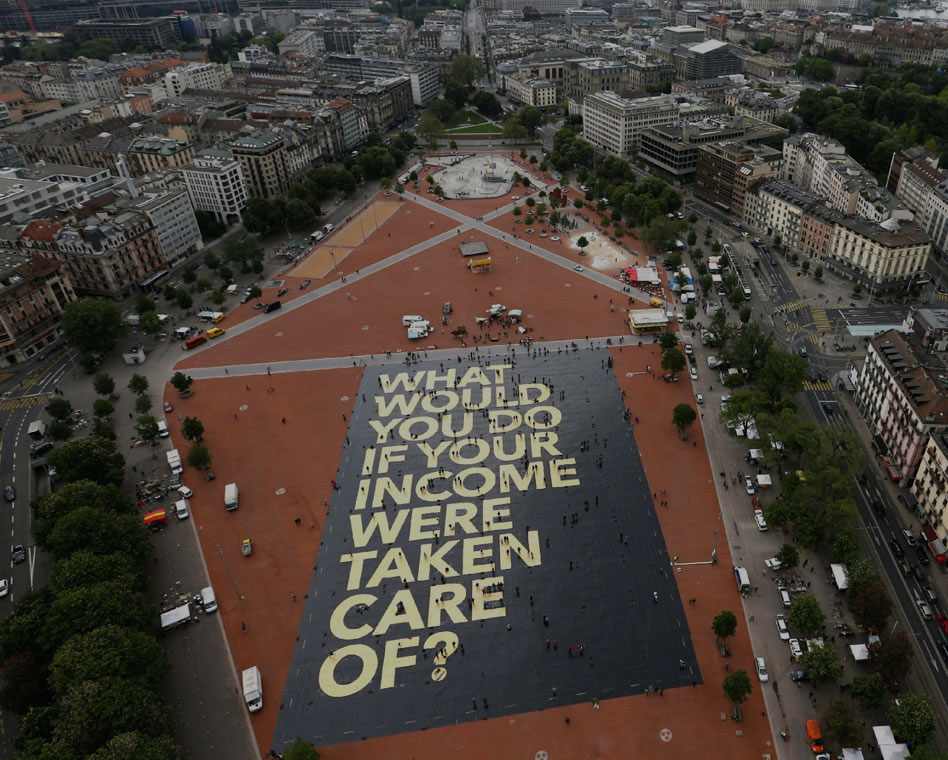

Can UBI be a game-changer for India?

To make UBI economically feasible, it is important to eliminate schemes and welfare programmes that impose a heavy cost on GDP and are prone to corruption and leakages.

By Adhiraj Singh Shekhawat

The concept of a welfare state paying everybody (all citizens) a uniform and an unconditional basic income (UBI) has roots in the history of Europe and America, dating back to the 16th century. In the last few years, the concept has not only gained traction in the political discourse worldwide, but also in India where UBI has emerged as a compelling argument in debates about poverty alleviation and public welfare schemes.

In India, it was prominently highlighted by the Chief Economic Advisor, Government of India, Mr. Arvind Subramanian, when he spoke at length about the topic in the 2016-17 Economic Survey. He had remarked, “Universal basic income is a radical and compelling paradigm shift in thinking about both social justice and a productive economy. It could be to the twenty-first century what civil and political rights were to the twentieth.”

Limitations of existing welfare schemes

There are thousands of programmes and schemes run by central and state governments in India aimed at poverty alleviation in the areas of food, housing, health etc. While all these schemes have been introduced with a positive intention, their success has varied across geographies due to various problems in implementation.

It has also been observed that providing subsidies leads to an increase in corruption because of disruptive market forces which try to neutralize the price disparity of the same product for different sections of the society. For example, under National Food Security Act, 2013 (NFSA), the Indian government provides food grains at a subsidised rate of Rs. 3/kg for rice and Rs. 2/kg for wheat to BPL section of the society. For the same commodity, the prices are set as Rs. 8.30/kg for rice and Rs. 6.10/kg for wheat for anyone outside the scope of NFSAi . The government bears a subsidy of Rs. 22/kg on wheat and Rs. 29.64/kg on rice.ii

This steep disparity in the price creates an enabling environment for malpractices and corruption to thrive. The government has been trying to address this challenge using Direct Benefit Transfer (DBT) of subsidies to the beneficiary’s account. While the DBT model solves the problem of benefit delivery mechanism, it does not address the issue of price disparity and identification of right beneficiary.

When the policy makers create a scheme that is targeted at certain poor and under-privileged sections of the society, the biggest challenges they are faced with is – how to identify the right beneficiaries? Often, a person who should be included to get benefits from a scheme gets excluded and one, who doesn’t need those benefits, becomes eligible for a scheme.

For example, the BPL list excludes many poor people and at the same time, a large number of people who are not poor manage to get their names in the list. A recent studyiii in Karnataka shows that more than two-thirds of ineligible individuals held a BPL card, while around one-sixth of eligible individuals did not have it. Even though Aadhaar correctly identifies a particular person, it doesn’t solve the problem of exclusion and inclusion. Some of these schemes involve subsidies that benefit the non-poor more, since they consume more of the relevant goods or services. For example, power subsidies favour those who have access to electricity and those who consume more power.

Can UBI address specific challenges?

With technological advancements such as introduction of Artificial Intelligence (AI) and automation across industries, many things are expected to drastically change. Physical labour as against mechanisation is expected to see a sharp decline causing unemployment on a large scale. The World Bank has estimated that automation threatens to eliminate 69% jobs across industry in India, 77% in China and 85% in Ethiopia. Moreover, as per Article 25 in the Human Rights Declaration signed by India at United Nations, it is state’s responsibility to provide for basic human amenities like food, shelter, clothes in order to ensure a dignified life to its citizens.

A solution that has been proposed to eradicate the problem of poverty, income disparity, and increasing unemployment is to provide a minimum unconditional grant that covers the basic needs of all the citizens. As per the Tendulkar committee, the poverty line has been set at INR 1090 per month.

However to provide a UBI of INR 1090 per month to a population of 1.28 billion people would cost approximately INR 1395.2 billion which is around 11.5% of India’s GDP (145 lakh croresv ). Clearly this can create a heavy fiscal burden on the country if introduced independently.

Economic feasibility of UBI

However, UBI can be made economically feasible if a cost of 11.5% of GDP can be covered by eliminating existing non-performing schemes and welfare programmes that are prone to corruption and leakages such as PDS, fertilizer subsidy, MGNREGA etc. While doing this, it is imperative to leave out current schemes in education, health and urban & rural development from this process. Studies from National Institute of Public Finance and Policy have shown that the fiscal savings from eliminating ‘non-merit’ subsidies would be around 8% of GDP.vi

To cover 4.5%, other potential sources need to be examined thoroughly. Imposing new taxes will only increase the income disparity and will become counterproductive. But the total revenue foregone because of tax exemptions such as corporate tax, personal income tax, excise and customs is approximately INR 591,287 crores i.e. 6.69% of GDP.vii

If this can be incorporated to fund UBI in addition to removing non-merit subsidies, the total adds up to 14.69%. This can help give a minimum basic income of INR 1390 per month to all the citizens of India. And this calculation does not even include the state sponsored subsidies and the scheme specific execution and management expenses. Therefore, with a more rigorous scrutiny of schemes, this figure of INR 1390 can be increased.

India’s UBI experiments

Two experiments have been conducted on UBI in Madhya Pradesh. One by Self-Employed Women’s Association (SEWA) and the other by UNICEF. In the first experiment which was conducted by SEWA, 20 villages were studied. Men, women and children of 8 villages received a basic income while men, women and children of the remaining 12 villages did not receive any basic income. Initially the amount of the basic income provided was Rs 200 for an adult and Rs 100 for a child. Later, these payments were increased to Rs 300 and Rs 150 respectively.

The second experiment was conducted in one tribal village as against a similar tribal village as a control group. Here the basic income was provided in cash directly to people.

The resultsviii of the two experiments demonstrated that the people who received the basic income were motivated to work more and people migrated from casual labour to own account farming and business activities. There was also an observed decrease in migration caused by distress. The UNICEF reports points out that in the tribal village, grants enabled small farmers “to spend more time and also invest on their own farms as opposed to working as wage labourers”.

Challenges in implementation of UBI

The idea of giving out free money does not conform to right-wing economists who believe unconditional cash transfer would lead to misuse of public money by the poor and would take away their motivation to work. It is also feared that people would not use the money for economically productive activities and would indulge in social vices like drinking, gambling, etc.

On the other hand, left-wing economists argue that giving out free money to people who are already rich would be a waste. This would not decrease the gap between rich and poor. It would only increase the net income for both rich and poor while maintaining the existing difference in earnings.

Therefore, even if the feasibility of UBI has sanctity in terms of cost and effectiveness, its real challenge would lie in its political feasibility. UBI has to conform to both right and left-wing economists while retaining the fundamentals of the concept.

The rigid bureaucratic system of implementing schemes would undergo a drastic change if UBI were to be implemented. The legacy of bureaucrats detailing schemes would also be totally disrupted and could create more hurdles for the implementation of UBI.

Conclusion

Implementing UBI in a country like India can prove to be an extremely challenging exercise. However, with its implementation, much corruption and leakages can be removed. It will also lead to better administration of resources and intelligent fund allocation. Moreover, this will empower people to take decision of using the money as per their requirements. This has to be coupled with rigorous financial literacy programs to educate people about income management.

It is also essential to understand that the UBI grant has to be adjusted accordingly with the growth in the country’s economy to cover inflation. Hence, if Universal Basic Income is implemented properly, it can be a big game changer in the Indian economy.

- i. http://fci.gov.in/sales.php?view=41

- ii. http://www.hindustantimes.com/business-news/display-foodgrain-subsidy-at-ration-shops-centre-tells-states/story-5NzLb7E0YNJ0Y78Wvvx9hM.html

- iii. http://econweb.ucsd.edu/~pniehaus/papers/rules.pdf

- iv. http://www.worldbank.org/en/news/speech/2016/10/03/speech-by-world-bank-president-jim-yong-kim-the-world-bank-groups-mission-to-end-extreme-poverty

- v. https://data.worldbank.org/country/india

- vi. http://epaperbeta.timesofindia.com/Article.aspx?eid=31815&articlexml=Discreet-Charm-of-the-UBI-18102016016021

- vii. https://www.dropbox.com/s/ozpgpzh8c6hknxy/Subsidies%20in%20India.pdf?dl=0

- viii. http://isa-global-dialogue.net/indias-great-experiment-the-transformative-potential-of-basic-income-grants/

Recent Posts