Consultant

Aug 04 2017

Crypto Currency: A Digital Investment?

With India now clearly defining its focus of shifting from cash to cashless, the roadmap for achieving a predominantly cashless economy exists. But is there now a need to embrace the next leap of technological innovation?

As India gains momentum on its financial inclusion and #GoCashless journey, the government circle and the banking fraternity is buzzing with discussion around the future course for crypto currency in India.

The scope of discussion was further widened when The Department of Economic Affairs in the Ministry of Finance formed an inter-disciplinary committee to examine the framework on virtual currencies. The soaring value of Bitcoin in international markets has been a major factor in leading governments across the globe to review this closely.

In this context, let us try to answer a simpler question. Should Bitcoin be banned or regulated by authority.

Bitcoin - Go Cashless Without an Intermediary

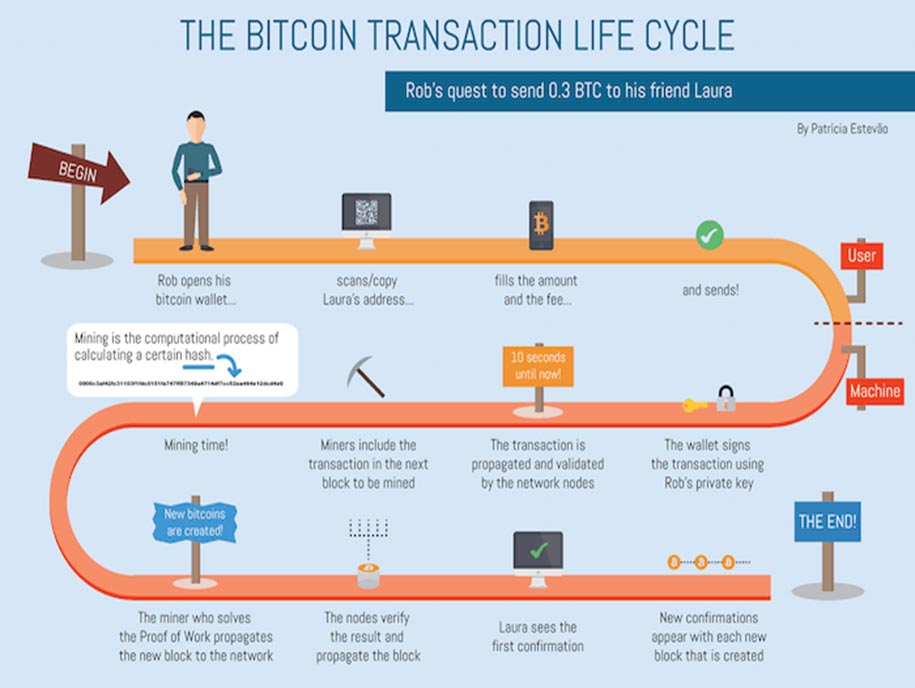

What is Bitcoin? To put it simply - it is a digital asset and a peer-to-peer payment system, supported by open source software, with no intermediaries like a bank, a credit card company or a clearing house.

This means that no person, company or country owns this network just like no one owns the Internet, thus making it a decentralized digital currency. Its flow is entirely driven by market demand hence its value always fluctuates.

The first Bitcoin specification and proof of concept was published in 2009 by an anonymous person under the pseudonym Satoshi Nakamoto, the value of a single Bitcoin has fluctuated over the years. Its value has ranged from the lowest of $.01 to the highest of $ 3000 with its current value at $2780 per Bitcoin. With companies like Microsoft, Dell, Wordpress among many others accepting Bitcoins as payment currency, it is gaining respectability and validation among the public.

How Bitcoin works?

Bitcoin for a Digital India

Many government initiatives are making a big difference in creating a more financially inclusive society through digital intervention, in particular, demonetization (a government’s move that invalidated Rs 500 and Rs 1000 currency notes in circulation) and Pradhan Mantri Jan-dhan Yojana (an initiative driven towards initiating financial inclusion on a large scale), which have contributed well into bringing people closer to Banks (read electronic payment modes).

With India now clearly defining its focus of shifting from cash to plastic money, the roadmap for achieving a predominantly cashless economy already exists. With additional initiatives being introduced such as Aadhar Enabled Payment System (AePS), Unified Payment Interface/Bharat Interface for Money (BHIM) app and an increased number of ePoS machines, the growth in electronic payment modes has been phenomenal.

Is there now a need to embrace the next leap of technological innovation?

Addressing Concerns Around Crypto Currency

The PHD Chamber of Commerce and Industry (PHDCCI), a trade and industry body released a survey on July 26, 2017, which points out that 97% of respondents across multiple industries are aware of bitcoin. While the group calls for more regulations, the survey sheds light on the opportunities Bitcoin can offer the country. The survey asked 223 stakeholders, from industries such as garments, textiles, drugs and pharmaceutical, electronics, machine tools, auto components, and leather, as reported in the media.

The report echoed the sentiments of the industry, “The RBI should now look deep into the concept of crypto currencies, including Bitcoins, and take a view on it.” The report stated that, “Arguably, Bitcoins can be a boon for the large population of the country which is still unbanked; it can provide them with a superior and simple peer to peer digital currency trading platform through desktops and mobile devices.”

Majority of Indians, who participated in the discussion on Bitcoin on MyGov (an innovative platform to build a partnership between citizens and Government with the help of technology for growth and development of India), also expressed interest in seeing Bitcoin become larger part of the financial and trading systems in the country.

However, concerns were expressed about its reliability as a currency as it doesn’t fall under the purview of any government-mandated monetary policy, and fluctuates in value. To add to this, earlier this year, India’s central banking institution Reserve Bank of India issued a note of caution to users and traders of virtual currencies about the risks of using Bitcoin.

While most Indians are trying to make up with the use of plastic money, some have already got onto the “currency of the future” – Crypto-currency.

Even though the Reserve Bank of India is yet to authorize the use of virtual currencies, crypto-currencies like Bitcoins and Ethereum have already made a dent into the Indian market. RBI has cautioned users, holders and traders of virtual currencies in India, including bitcoins, about the potential financial, legal and security risks that could arise. Despite this call of caution, there are claims in the public domain about ZebPay, a domestic Bitcoin exchange, having added over 2,500 users a day having reached five lakh downloads.

Up until UPI (Unified Payments Interface) was introduced, Net banking was a tedious procedure. Online transactions have become much simpler with UPI. But UPIs still use a middleman i.e. the bank itself, hence there are certain regulations that the government can impose. On every transaction, an average user pays up to .615% in bank charges and conversion fees. Using a third party also compromises with the safety of a customer’s bank account. Crypto-currencies remove all these implications.

What makes Bitcoin secure is the Blockchain technology which basically distributes the whole transaction history across the globe, thus once a transaction is done, it cannot be reversed back.

The Way Forward

Given the growing acceptability of cryptocurrency in international markets and also increasing interest within industry circles and in citizens, a ban on crypto currencies like Bitcoin is highly unlikely. As a matter of fact, it would go against the government’s current drive on “go cashless”. All signs point towards the government legalizing/taxing Bitcoin and other virtual currencies. So let’s watch out for this space for another few months.

With Inputs from Sreelakshmi,

A 1st year student of Mass Communications and Journalism

Lady Sri Ram College

References:

- http://www.economist.com/bitcoinexplained

- https://go.ted.com/CyR6

- https://www.zebpay.com/legal

- https://bitcoin.org/en/how-it-works

- http://www.businessinsider.com/why-bitcoin-could-thrive-in-a-country-like-india-2017-6?IR=T

- https://www.forbes.com/sites/sindhujabalaji/2017/06/21/bitcoin-india-regulation/#498b798d7e4a

- http://economictimes.indiatimes.com/news/economy/policy/government-steps-up-vigil-on-bitcoin-transactions/articleshow/58911702.cms

- https://news.bitcoin.com/indian-multi-industry-survey-bitcoin/

- http://timesofindia.indiatimes.com/business/india-business/banks-may-cut-upi-charges-for-merchants/articleshow/59746229.cms

Recent Posts