Dec 21 2016

Motivating Bank Mitras

The RBI already has a system in place that encourages banks to address last mile connectivity issues through a system of Bank Mitras (BMs) or Banking Correspondents who perform basic services for its customers i.e. account opening, small deposits and small withdrawals. BMs, loosely translated as ‘friend from the bank’, is an army of 1,14,518 1

active banking correspondents recruited to fill the geographical last mile for Pradhan Mantri Jan Dhan Yojana (PMJDY). The BMs are appointed by banks and are responsible for providing and advising customers in remote areas where normal banking services cannot be made available to the common man. BMs not only bridge the physical distance between people and banks but also the psychological gap of intimidation and fear of the poor to interact with bank and banking products. Hence, BMs are perfectly placed to guide the poor because they know the customers personally and can provide support in the language and methods that customers understand.

As per the PMJDY scheme, any firm, organisation or individual who is above 18 and studied class 10th can become a Bank Mitra (BM) 2 by passing a basic screening test conducted by banks. This simple process of hiring BMs should have given us enough BMs to solve the issue of reach and connectivity of banking in India by now but banks haven’t been able to motivate their BMs to make them stay long and work with consistency and passion. The result of this high number of BMs are either dormant or quitting. The common grievances of BMs are; i) they do not get enough compensation, ii) they are not treated well by bank employees, iii) they do not see any career growth working as a BM etc. BMs get a fixed compensation of ? 2000-? 5000 that most complain of struggling to even cover their overhead costs. As per Centre for Digital Financial Inclusion’s (CDFI’s) findings from a study, an average rural BM covers and services 11 sq. KMs of area a day but do not get any reimbursement for fuel and travel costs. Overall, the BMs earn so less that every second BM interviewed in the study felt the need to have a secondary source of income.

The coverage and service of BMs are very important for financial inclusion as no other entity can support bank and bank related activities with the reach and service of BM. To keep the BMs motivated, the Government and banks need to work towards solving their problems and grievances. To initiate this, banks have to look into ways of incentivizing BMs through non-monetary incentives, economic incentives and remuneration structure.

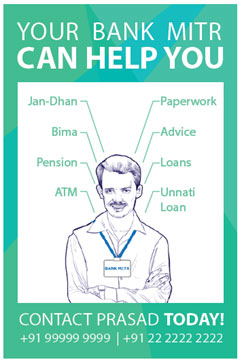

Motivating through Non-Monetary Incentives: The BMs cadre has seen considerable enhancement in their social standing since the account opening phase. This is evident seeing the change in respect that BMs received from acquaintances before and after they joined PMJDY. They say, “The same people who called us bhaiyya-bhabhi now call us Sir-Madam”. It is this respect and enhancement in stature that should be leveraged to attract talent towards BM profiles. Others value the respect and social recognition from being associated with the Government as well as the banking system. Giving the BM access to official bank and PMJDY scheme logos on a banner at his workplace, and in the form of desk-flags and badges will enhance their stature. Boldly advertising the kinds of products and services the BM can offer to account holders will showcase their importance.

Many BMs have an empathetic view towards the financially excluded and derive satisfaction from contributing to a larger cause. Instituting ‘Social Crusader’ awards for BMs will accentuate their contribution towards financial empowerment and social change.

However, BM face challenges of integration with the bank branch. With regards to ground-level logistics, there is much left to be desired in support for the BMs. Bank employees are do not want to empower an external cadre like BMs, resulting in biases against them. As a result, many BMs feel side-lined and demotivated because of the treatment meted out to them at their workplace. Thus, an important lever to improve the effectiveness of BMs is enhancing their stature. This can be achieved by empowering BMs with more products as well as para-banking activity such as initiation of loan recovery. But it will be more fruitful to manage the BMs’ relationship with the bank branch by improving co-operation, assigning a ‘guardian’ bank employee to ensure their general welfare and act as a channel of communication between internal and external employees.

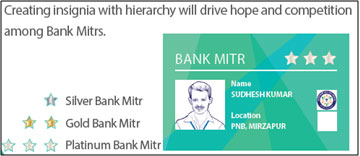

Lastly, improving official branding and insignia with hierarchy for BMs (Silver BM, Gold BM and Platinum BM) will enhance their sense of competition, ownership and belonging under the aegis of the bank.

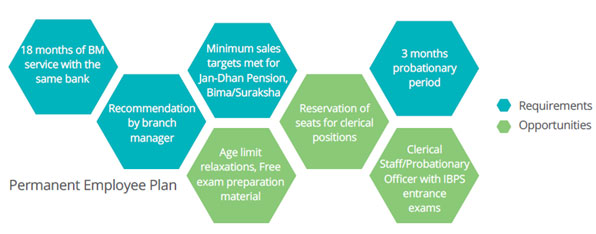

Motivating through Economic Incentives: Many BMs, certainly by intention, and to a limited extent by action, look at their assignments with a long-term view. Their long-term goals are aligned to personal ambition, which is entrepreneurial and not part of the PMJDY hierarchy. Others are keen to have the reassurance and fixed perks of being permanent employees of their bank, even at a lower designation. Chalking out long-term plans of high-performing BMs by placing them in a plan of their choice and aptitude will motivate BMs to align their personal ambition with performance. Make Bank Mitrs look forward to their long-term goals such as becoming a permanent employee of the bank, or start a financial services business in partnership with the bank, leveraging the large client database formed with PMJDY. Lastly, highlighting the saliency of their goals can also be motivating for the BMs. Let the BM email or record periodic updates on engagement progress in each of the villages/neighbourhoods under him, with respect to: village/neighbourhood name, account opened, Overdrafts availed by some account holders etc. BMs can be trained on para-banking activities such as collection of loans, collection of small loans, field verifications and credit inspections. Finally, banks can develop institutional capabilities of leveraging this auxiliary sales force. This expansion of duties and responsibilities will also alleviate the dip in motivation experienced by BMs due to lack of tangible goals in the engagement phase of PMJDY.

FIGURE: Expanding Range of Powers & Responsibilities of BM

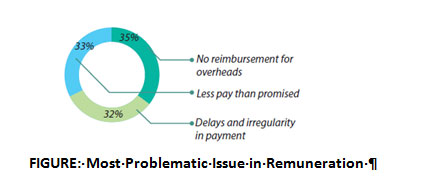

Motivating through Remuneration & Commission Structure:

As stated above, another emotionally salient grievance among BMs is the lack of reimbursements for fuel and travel costs for the wide areas they are expected to service. This feeling of unfairness is exacerbated by the time spent in commute, which increases their average working day to about 9.5 hours. In rural areas, they visit neighbouring towns or villages for 9 days a month on average.

If an expansion of budgetary outlay for the scheme is planned by the government and the banks, compensation for daily expenses be addressed ahead of other requirements. Variable compensation can be made to be higher at lower levels of sales to account for fixed overheads of BMs. As overheads are taken care of at higher levels of sales, the increase in variable compensation need not be as steep. Reimbursements need to be re-calibrated for urban and rural areas. In the former, fixed costs are high because of transportation; in the latter, the same is high because of high rent.

Overall, tweaking a few minor issues using behavioural levers, with regards to their motivations and dynamics at their workplace will go a long way in ensuring that the services of this hard-working cohort are successful.

Note: All figures are based on the Centre for Digital Financial Inclusion’s (CDFI’s) study on Bank Mitras.

http://pmjdy.gov.in/infrastructure

http://bankmitra.org/bank-mitra/

Recent Posts