Nov 14 2018

Understanding Agricultural Mechanization and its Prospects in India

The Economic Survey of 2017 points out that by 2050 the movement of labour away from agriculture will gather momentum witnessing a drop to 25.7% from 54.6% with half of the Indian population residing in cities1. It is also expected that by mid-century the country will have an additional 430 million mouths to feed. The farming landscape of India currently comprises of small and marginal farmers (with less than 2ha of farm size) who make up 85% of all agricultural households with an average land holding of 0.6 ha of land2. With the added pressure of population, the average landholdings have become increasingly fragmented across years.

The onus is upon us to change how food is produced, processed and supplied to tackle this challenge. The domain of production could reap benefits through improvements in soil and water management, reviving heirloom seeds and farming practices, adequate credit financing and farm mechanization. The push for mechanization of agriculture is underscored by its potential to boost efficiency by bringing down time, drudgery, post-harvest losses and thus increasing crop output.

Trends in Investment and Mechanization

Fixed capital expenditure in farm business (FCEFB) is a measure of private investment in agriculture and allied activities. It comprises of eight components, the major ones being land improvement, livestock, irrigation, transport, and machinery and implements. The Doubling Farmers Income Report 20173, which uses NSS-AIDIS data of 2012-20134 observes a growth in FCEFB in the decade that ran up to 2012, however its share in the Gross Capital Expenditure hasn’t increased significantly. Meanwhile a lot of states including Tamil Nadu experienced a significant decline in share of investments in agriculture (in gross investment) indicating a shift from farm investments. The survey points to the fact that bulk of the investments in FCEFB of rural households went to farm machinery and transport making up 36.9% of total investments. But a closer look at the break-up shows us that the combined share of small and marginal farmers in FCEFB is 9.5% in almost all the states. Thus despite being the largest group of cultivators, small and marginal farmers do not spend on mechanization. This could primarily be attributed to the infeasibility of investing in heavy machinery considering their marginal landholdings that works against economies of scale.

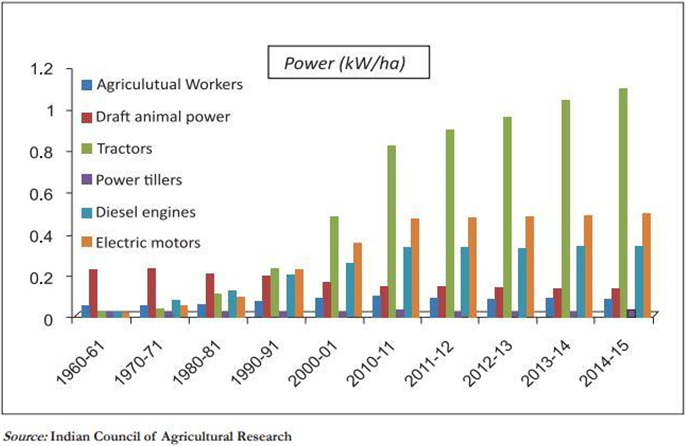

Farm Power is defined as the sources of energy in farm work and includes human, animal, oil and electric sources. It is a critical input in operating farm equipment and carrying out other field operations. Quite evidently over the years, along with an increase in farm power availability, there has also been a shift from manual sources to mechanical and electric sources of power. This indicates that additional needs of sources were met through the latter. This to a great extent is indicative of the willingness to accept higher level of technology on farms. Tractorisation has been the prime mover of mechanization in the country with tractor sales in the country growing with a compound annual growth rate (CAGR) of 5.5 % in the last decade5. That having been said, it isn’t an absolute measure of mechanization and there needs to be a focus on the availability of other agricultural equipment as well. Availability of farm power is proven to also have a direct correlation with productivity. The Sub Mission on Agricultural Mechanization (SMAM) in the year 2014-2015 aims for a per hectare farm power of 2kW/ha6.

Market Solutions

The challenge now is to make high-end agricultural machinery at affordable rates available to farmers as and when they need it. Much rides on the concept of Custom Hiring - a rental model where farmers can hire farm implements at nominal rates. Amongst other government support, the SMAM provides subsidies in setting up these high-tech machinery hubs targeting selected crops. There have been private and government initiatives in promoting this model of mechanization. From a pay-per-use model to specialized customer-facing centres (Samadhan Kendras by EM3 Agri Services, Zamindara Farm Solutions, etc.), private players are dipping their feet into the market.

It needs to be noted that the rental-hiring model is different from CHC. This is because CHCs exists through a government subsidy, making the choice of machinery a joint decision of the NGO/Company and the local agriculture authority. In the rental/hiring model it would be the company often along with the resource institutions/NGOs that provide the finances and the technical know-how to run the hiring systems. Many equipment manufacturers including Mahindra and Mahindra, TAFE and John Deere are venturing into the Indian market exploring various business models of equipment renting7.

These models try to bridge gaps in the market, providing farmers valuable know-how on new technology that matches with their scale, bypassing the prohibitive costs of buying equipment, and increasing the per hectare availability of farm power. They leverage the benefits of digital technology by tracking machine usage, fuel consumption and maintenance. This provides incentives for banks to lend to farmers/individuals who wish to buy such equipment. These technologies are critical and conducive in scaling- helping equipment owners monitor their fleet and overcome constraints of geography and time and ensure transparent transactions and quality service to farmers.

The CDFI Initiative

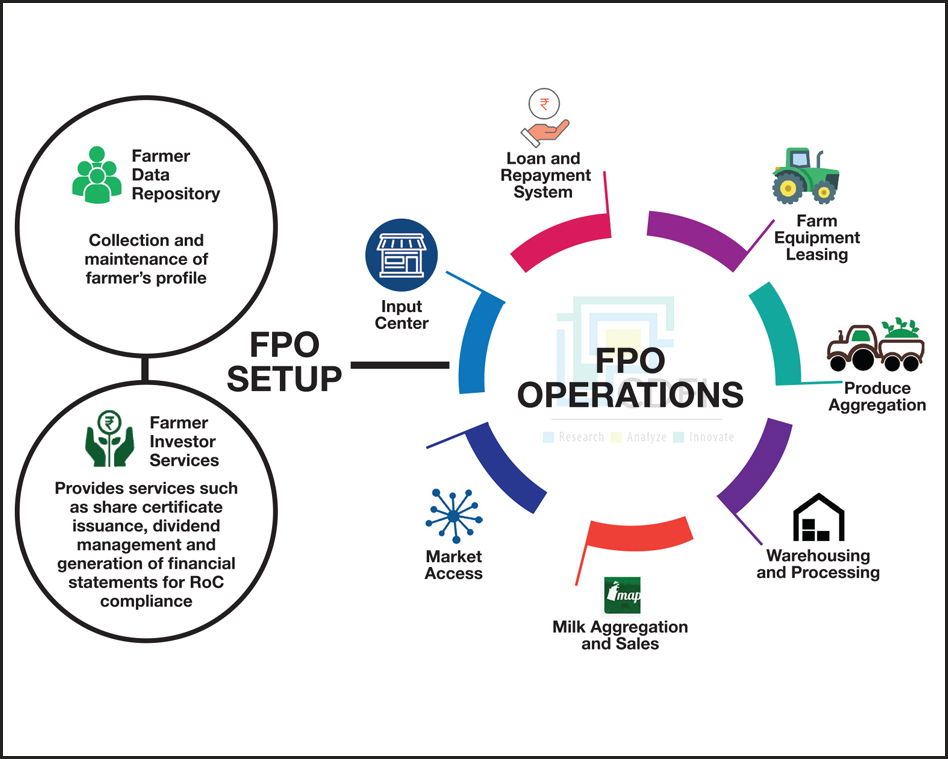

It is in this backdrop that CDFI has piloted the Farm Equipment Leasing mobile app based on a rental/hiring model. It forms one of the modules of KANCHI- a web and mobile based platform aimed at digitizing typical activities of farmer producer organizations (FPOs - association of farmer groups). The ‘pay and use’ application aims to bring together farm equipment owners and farmers onto a single platform while assuring the former of a ready market and the latter of timely access to required farm equipment with functionalities that enable digital invoices and payments.

The benefits of Farm Equipment Leasing app can be seen in the context of the holistic services that the KANCHI platform provides for small and marginal farmers. Farmer financial inclusion lies at the heart of the KANCHI platform and by capturing credit and repayment transactions of small and marginal farmers, KANCHI tries to upgrade farmers from ‘credit-invisibles’ to “Credit worthy’. This additional data lets them be meaningfully scored and increases the number of credit-worthy potential borrowers. Farm Equipment Leasing module thus fits into the larger ambit of activities that KANCHI maps including input purchases, dividends received, credit received and repayments made by the farmer.

Additionally, while it is unattractive to cater to average pockets of non-contiguous farms of less than 1 ha, a group of farmers in proximity makes the market viable. An FPO-centric model as piloted in Tamil Nadu holds this promise and is also conducive to CHC subsidies of the government. Finally, it supports enterprising individuals/farmers by providing them a ready platform that aggregate and manage demand.

1. India. Ministry of Finance. Economic Survey 2017-2018. January 29, 2018. Accessed November 2, 2018.

http://mofapp.nic.in:8080/economicsurvey/index.html

2. India. Committee on Doubling of Farmers' Income. Department of Agriculture Cooperation and Farmers Welfare. Doubling of Farmers' Income. By Ashok Dalwai. August 2017. Accessed November 2, 2018.

http://farmer.gov.in/imagedefault/DFI/DFI Volume 2.pdf.

3. Ibid.

4. India. National Sample Survey Office. Ministry of Statistics and Programme Implementation(MOSPI). All India Debt and Investment Survey. 70th Round. 2013.

5. Grant Thornton, and FICCI. Mechanisation: Key to Higher Productivity to Double Farmers’ Income.Report. 2017. Accessed November 4, 2018.

http://www.grantthornton.in/globalassets/1.-member-firms/india/assets/pdfs/eima-agrimach-2017.pdf.

6. India. Department of Agriculture Cooperation and Farmers Welfare. Ministry of Agriculture. Sub-Mission on Agricultural Mechanization: Operational Guidelines. 2014. Accessed November 3, 2018.

https://farmech.dac.gov.in/SMAM/SMAM1.pdf.

7. YES BANK, Food and Agri Strategic Advisory and Research (FASAR), and German Agribusiness Alliance at OAV - German Asia-Pacific Business Association (GAA). Farm Mechanization in India: The Custom Hiring Perspective. Report. July 2016. Accessed November 5, 2018.

https://www.oav.de/fileadmin/user_upload/1_Meldungen/Indien/in_161013_FARM_MECH_REPORT.PDF.

Recent Posts