Dec 07 2016

Understanding Financial Inclusion Models- Part I of V

Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services to meet their needs – transactions, payments, savings, credit and insurance- delivered in a responsible and sustainable manner. i

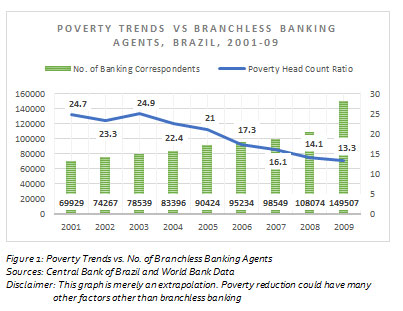

World over, measures are being taken to promote financial inclusion as one of the major proponents of poverty alleviation. Studies have shown a strong correlation between financial inclusion and lower poverty rates. For instance, in Brazil, with the increase in the branchless banking model f0r financial inclusion, the poverty head count ratio has decreased significantly. ii

Globally, multiple channels for financial inclusion are being explored / tested to bring the excluded into the folds of formal financial services. In India, which follows multiple channels for financial inclusion, evidence has shown that increase in the number of bank accounts has been accompanied by a reduction in poverty levels in some states. For instance, in the period between 2000 and 2007, Kerala saw a growth in deposits bank accounts by 3.4% while the poverty levels in the state in the same period declined by 3.82%. iii For India, which is at the cusp of a cashless revolution, learnings from some of the global financial inclusion models can assist in speeding up the pace of such a transition.

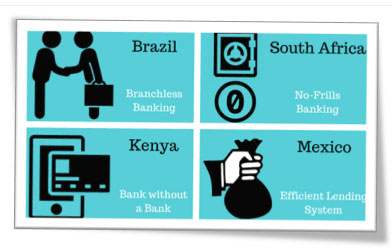

This blog series will present financial inclusion models from four countries, namely, Brazil, South Africa, Kenya and Mexico and will attempt to understand their feasibility in the Indian context and identifying some best practices that may contribute to enhancing the rate of financial inclusion. The first blog of this series will detail the branchless banking model of Brazil and compare it with India’s banking correspondent model.

Brazil: Branchless Banking

The Model

The Brazilian financial inclusion model spreads access to banking through agents called Banking Correspondents (BCs). While the BC model existed in Brazil from the 1970’s, full-fledged operations only began in 2000 after regulations were eased and range of services were broadened. The new laws came into force owing to the low penetration of banking services in the country. As of 1997, only 40 million Brazilians of the total population of 62 million had access to any financial services. iv

After 2000, the BC model grew rapidly with 1.5 lakh BCs accounting for 62% of the total number of points of financial services. Subsequently, the total number of bank accounts in Brazil doubled between 2000 and 2008, from 63.7 million to 125.7 million.v Additionally, the BC model grew 85.5% while bank branches grew only 16.7% in the same period. vi The agents are engaged by banks and are authorized to deal with credit facilities, and some of them can open bank accounts and handle depositsvii

The BC agents in Brazil cater to the needs of different customers spread across the entire geography of the country. It has been observed that rural agents largely perform deposits and withdrawals while bill payments dominate the urban landscape viii

Challenges

While the agent banking model has been effective in bringing many into the folds of formal financial services, many agents face difficulties in performing their activities. Firstly, as of 2010, the remuneration for these agents is low with an average commission of USD 48.5 per day and an average profit of only USD 5.17. Secondly, liquidity management is another issue which often manifests as a threat of robbery. Lastly, network connectivity issues in many areas also results in hindrances in carrying out financial activities.ix

India: Banking Correspondents

The Model

In India, a similar model was initiated in 1928 by Syndicate Bank known as the Pigmy Deposit Scheme. Under this scheme, Pigmy agents, who were engaged by various banks, were responsible for collecting savings from individuals such as daily wage labourers, small traders and farmers to inculcate the habit of savings and to also create a larger fund in times of requirement. While this scheme had its merits, it eventually got entangled with litigation roadblocks. The primary reason for this was the fact that the agents went around claiming to be bank employees which led to multiple disputes and litigation. While the model was revamped and relaunched in 2007, it continues to be heavily challenged.x

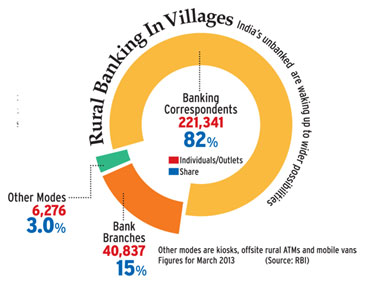

Recognizing the problem that a large portion of the population was unbanked, the Reserve Bank of India introduced a regulation allowing banks to provide services at people’s doorstep through the use of third party services. The BCs are intermediaries who are attached to banks and provide handholding support to sensitized beneficiaries to avail financial services by transgressing the otherwise tedious and complex process of approaching a bank. In addition to this, it allows for the last mile delivery of financial services in regions where the penetration of banks is lean.

The BC agent was authorized to offer services such as cash transactions where the lender does not have a branch. In lieu of their services, banks pay the BCs a commission from the bank for enrollment of clients, transactions, deposits, etc.xi

There has been a significant rise in the number of BCs in India. In addition, there has been a reduction in poverty levels. This has been illustrated in the graph below

Challenges

While the branchless banking model is most suited for India (given its size and other complexities), it has not been able to demonstrate a business case for the banks or even the agents. The BC networks in India have been weak with an annual attrition rate of 25%-35%. This is largely because the agents are paid commission at the rate of 1% only which does not serve as enough incentive for them.xii In addition, there are cash management and liquidity issues as well as internet connectivity issues that hinder the activities of BCs. However, given the advantages of BCs as agents of last mile delivery of financial services, the model remains the most prevalent methods of financial inclusion in India.

Comparison

There has been a rise in the number of BC agents in both the countries since inception (Figure 1 and Figure 4) and the rise has been consistent- much in tandem with the rise in population. While both models have encountered their share of hurdles in the process of financial inclusion, the positive impacts of BC agents as last mile delivery means for financial services cannot be ignored. The positive trends in the BC agents’ numbers is evidence of the fact that such a model for financial inclusion continues to be preferred even though multiple issues plague it.

Conclusion

With minor policy level interventions, the BC model can be made pivotal in changing the financial inclusion space in the coming years. If the BC networks can be made profitable and the commission to BCs can be increased, such a model has the potential to grow manifold in the coming years.

In India, with Direct Benefit Transfer (DBT) payments becoming an important pillar for financial inclusion, the success of such payments relies largely on the quality of the last-mile delivery services provided by the BCs which disburse payments and enable bank account access. According to the Task Force on Aadhaar-Enabled Unified Payment Infrastructure, an estimated 3.14% DBT commission would be needed to ensure a robust rollout of BCs. However, the current rate of DBT commission, as mandated by the Government, is 1% for rural areas.

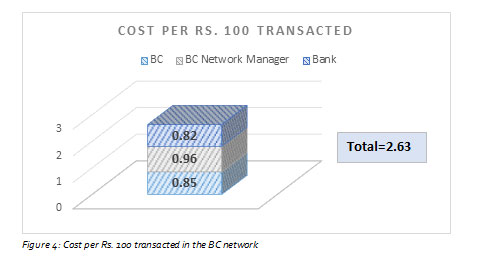

A recent MicroSave study found that the cost to banks for processing payments through the BC network is at least 2.63% for each transaction making it unviable for BCs to engage in such activities. The data for every Rs. 100 transacted is as follows

The cost for maintaining the DBT service channel is much more than the amount provided by the Government as commission. In addition to this, BCs in low-density locations, like tribal areas, cannot cover costs as the volume of transactions are not sufficient. Given such a situation, a 3.14% commission for BCs may be considered for successful operations. xiii

With added emphasis on cashless transactions post-demonetization, the role of the BC will evolve from a cash collector/distributor to the provider of multiple banking services including credit. Given this trend, the BC model is definitely going to become even more indispensable to India’s financial inclusion landscape.

http://www.worldbank.org/en/topic/financialinclusion/overview

http://data.worldbank.org/country/brazil & https://www.bcb.gov.br/en/

Bhandari, A. K. (2009, April). Access to Banking Services and Poverty Reduction: A State-wise Assessment in India. IZA.

http://www.forbesindia.com/article/financial-inclusion/financial-inclusion-models-from-around-the-world/19292/1

http://www.forbesindia.com/article/financial-inclusion/financial-inclusion-models-from-around-the-world/19292/1

http://www.ifmr.co.in/blog/2010/07/28/correspondent-banking-in-brazil/

http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2012/06/agentnetworksinbrazilcgapfgv1_7.pdf

http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2012/06/agentnetworksinbrazilcgapfgv1_7.pdf

http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2012/06/agentnetworksinbrazilcgapfgv1_7.pdf

http://www.oneindia.com/2007/03/01/syndicate-bank-relaunches-pigmy-collection-scheme-1174137440.html

https://letstalkpayments.com/banking-correspondent-channel-financial-inclusion-india/

https://www.microfinancegateway.org/library/how-1-dbt-commission-could-undermine-india%E2%80%99s-financial-inclusion-efforts

https://www.microfinancegateway.org/library/how-1-dbt-commission-could-undermine-india%E2%80%99s-financial-inclusion-efforts

Tags

Recent Posts